DO-IT-YOURSELF

ESTATE

MANAGEMENT

Is it Possible?

The Better Question: Why Would You Want to?

Introduction

In an era where DIY (Do-It-Yourself) has become a mantra for everything from home renovations to personal finance, it's no surprise that many consider handling their own estate planning and estate administration . The question isn't just about whether it's possible – in Ontario, as in many jurisdictions, it certainly is – but rather, why would you want to undertake such a complex and critical task on your own?

Each Matter is Unique . . .

Despite the complexities and risks which we will outline below, there are scenarios where managing your estate planning or administration could be beneficial. For individuals with a straightforward estate and a clear understanding of their objectives, DIY estate management can offer a sense of control and personal involvement in securing their legacy. Additionally, it can be cost-effective for those with limited assets or uncomplicated estate planning needs .

The process can also be educational , providing a deeper understanding of financial and legal affairs that could be beneficial in other areas of life. Moreover, in the era of digital resources and accessible legal tools, the barriers to effective self-management are not as insurmountable as they once were.

Estate Planning Checklist

Navigate Estate Planning with Ease! Our comprehensive checklist guides you through asset inventory, beneficiary designations, wills, trusts, and tax considerations, tailored for Ontario, Canada. Ideal for anyone looking to secure their legacy. Simplify your estate planning journey today!

$29.95

FREE for a Limited Time

But wait . . . on the flip side . . .

Understanding the Terrain of Estate Planning

Estate planning isn't just about drafting a will. It's a comprehensive process that involves understanding intricate legal and financial landscapes . Crafting a will, setting up trusts , planning for taxes , and ensuring your wishes are clearly and legally articulated requires not just a basic understanding of the law, but also an awareness of potential future legal changes and personal circumstances.

Complexities of Estate Administration

Similarly, administering an estate without professional help can be a Herculean task . From applying for probate to managing estate taxes , and from distributing assets to beneficiaries to settling any outstanding debts or legal disputes , the process is laden with responsibilities that can be overwhelming for the untrained individual.

Estate Administration Checklist

Efficiently Manage Estate Administration! Discover our concise checklist, covering key steps from probate to asset distribution, tailored for Ontario, Canada. Streamline the process of settling an estate, ensuring compliance and peace of mind. Perfect for executors and families.

$29.95

FREE for a Limited Time

Risks of DIY Estate Management

Legal Risks - Minor errors in drafting a will or administering an estate can lead to major legal disputes. The lack of legal expertise might lead to a will being contested or misinterpreted or estate trustees becoming liable for damages.

Financial Oversights - Without in-depth knowledge, there’s a risk of overlooking critical financial aspects, leading to a loss for the estate or beneficiaries.

Tax Complications - Misunderstanding tax obligations can result in financial penalties or a larger tax burden for the estate or its beneficiaries.

Emotional Toll - Managing an estate, especially of a loved one, can be emotionally taxing. Adding the complexity of legal and financial management can compound this stress.

Why Professional Guidance is Crucial

Professionals bring not only their expertise but also their experience in dealing with complex situations. They can navigate the legal intricacies and ensure compliance with current laws. Moreover, they can offer objective advice, crucial in emotionally charged situations like estate division among family members.

The Value of Your Time and Peace of Mind

One must also consider the value of time and peace of mind. The time spent learning, planning, and administering could be significant, and for many, this time could be better spent on other pursuits. Additionally, the peace of mind that comes from knowing your estate is in expert hands is invaluable.

Conclusion

While it is possible to handle estate planning and administration on your own, the question remains: why would you want to? The risks involved, coupled with the complexities of legal and financial systems, make this a task best left to professionals. By doing so, you ensure not just legal compliance and financial optimization for your estate but also peace of mind for yourself and your loved ones. Remember, some tasks are worth entrusting to those who do them best.

Finding a Middle Ground:

Combining Self-Education with Professional Insight

The Compromise Approach

While the debate often swings between complete DIY estate management and full reliance on professionals, there exists a middle ground that can offer the best of both worlds. This approach involves becoming well-educated on estate planning and administration while still leveraging the expertise of professionals. Here's how this compromise can work effectively:

1. Education Yourself Thoroughly

The first step is to gain a robust understanding of estate planning and administration. This involves researching the legalities of wills, trusts, estate taxes, and probate processes in Ontario. There are numerous resources available, including books, online courses, and informative websites, that can provide a solid foundation of knowledge. Our blog has been designed precisely for this purpose – to bring to you the questions and answers most common to every aspect of estate planning and estate administration so that you can make intelligent and well-informed decisions and do so in the most cost-efficient manner possible.

2. Draft Preliminary Documents or Sketches of Your Plans

With your acquired knowledge, begin drafting your estate planning documents or an estate administration plan or sketches of your plans on what you wish to accomplish. These initial drafts or sketches don't have to be perfect but should reflect your understanding and wishes.

3. Consult with Professionals for Review and Advice

Once you have your drafts or sketches, consult with an estate lawyer, accountant or financial advisor. The professional can review your documents, suggest improvements, and ensure legal compliance. This step is crucial to avoid any oversights or errors that could have significant consequences.

4. Maintain Control and Decision Making

Throughout this process, maintain control over the final decisions. The professional advice should guide and inform your choices, but the ultimate decisions about your estate should align with your wishes and objectives.

5. Periodic Reviews and Adjustments

Estate planning and administration are not static processes. As your life circumstances change, so should your estate plans. Periodically review your documents, and if necessary, consult with professionals again to make adjustments.

6. Cost-Effectiveness

This approach can be more cost-effective than fully outsourcing estate management. By doing the initial work yourself and consulting professionals only for review or specific advice, you can reduce the overall cost.

7. Personal Satisfaction and Confidence

By taking charge of your estate planning or administration, you gain personal satisfaction and confidence in knowing that your estate matters are handled as per your specific wishes, with professional backing ensuring legal soundness.

Conclusion

This balanced approach allows individuals to take full carriage and control of their estate matters while mitigating the risks associated with complete DIY estate management. It offers a personalized and cost-effective solution, ensuring that the final outcome is both legally sound and closely aligned with personal intentions. This compromise between self-management and professional guidance empowers individuals to craft an estate plan or administer an estate with confidence, knowing they have the support of professional expertise where it counts.

The Society for Trusts and Estates Practitioners

Achieving the status of a STEP Affiliate with the Society for Trusts and Estates Practitioners is a mark of professional distinction. It highlights a commitment to the highest industry standards in managing and transferring personal wealth. As an Affiliate, one joins an elite global network dedicated to continual learning and ethical practice in the field of trusts and estates. This affiliation assures clients and peers of the individual’s expertise in the complex areas of estate planning and succession law, signifying a high level of competence and dedication to the profession.

Our Office

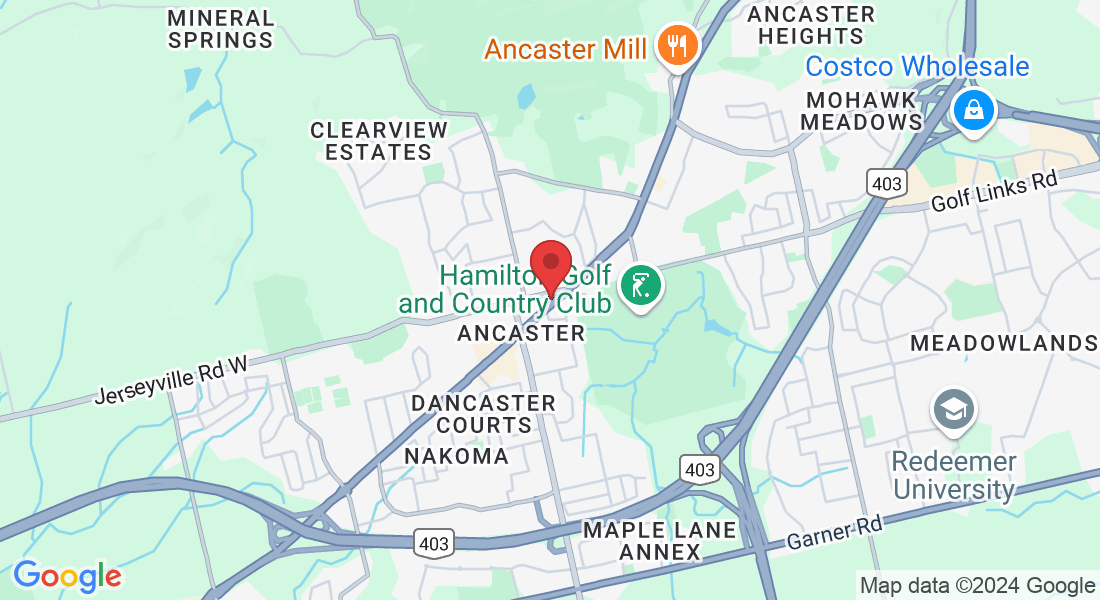

Filice Law Professional Corporation

71 Wilson Street East

Ancaster, Ontario L9G 2B3

Tel: 905-383-0828

Email: [email protected]

Pages

How We Can Help

Resources

(c) 2023 Filice Law Professional Corporation

Website by Magellan Publishing Inc.